1. What is Pag-IBIG Fund MP2 Savings Program?

The MP2 Savings Program is a voluntary savings program for members who wish to save more and earn higher dividends

than the regular Pag-IBIG Savings Program.

2. Who can save under the Program?

• Active Pag-IBIG Fund Members; and

• Former Pag-IBIG Fund Members with source of monthly income and/or Pensioners, regardless of age, with at least an equivalent of 24 monthly savings.

3. Is there a minimum amount to what I can save under the MP2?

Yes. The minimum MP2 savings is PhP500.

4. Is there a limit to how much I can save?

There is no limit. You can save as much as you want under the MP2 Savings Program. In the event that you wish to save an

amount exceeding PhP500,000, you would have to remit the amount via personal or manager’s check.

5. How do I save under MP2 Savings Program?

You may regularly save a minimum amount of PhP500 in your MP2 Savings. You may also opt for a one-time savings.

6. How much dividends will my savings earn?

Your MP2 Savings shall earn dividends at a higher rate than that of the regular Pag-IBIG Savings Program. The dividends you

shall earn are tax-free.

Your dividends are derived from no less than 70% of the Pag-IBIG Fund’s annual net income.

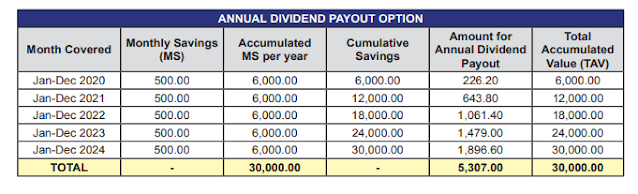

Our 3-year average MP2 Dividend Rate is at 6.96%. Last year, the MP2 Dividend Rate was 8.11% - its highest ever. Kindly

refer to the table in this brochure for indicative MP2 Dividends that your MP2 Savings may earn.

7. When can I receive my MP2 Dividends?

You can choose to receive your MP2 Dividends through any of the following options:

• Upon its 5-year maturity, with your MP2 Dividends compounded; or

• Annually, with your MP2 Dividends credited to your savings or checking account with Land Bank of the Philippines (LBP),

Development Bank of the Philippines (DBP) or other banks that the Pag-IBIG Fund may accredit in the future. For

members who opt for annual dividend pay-out but have no Philippine bank account, especially in the case of overseas

members, MP2 Dividends shall be released via check payable to the MP2 Saver.

8. Can I re-apply for a new MP2 Savings once my MP2 Savings matures?

Yes. Once your MP2 Savings reaches its 5-year maturity, you may re-apply for a new Pag-IBIG MP2 Savings

Account.

Members may claim their MP2 Savings anytime upon its maturity. If unclaimed, your MP2 Savings shall continue to earn

dividends based on the regular Pag-IBIG Savings Program’s (P1) rates for two more years. After which, it shall be treated

as an accounts payable and shall no longer earn dividends.

9. Am I allowed to have more than one (1) MP2 Savings Account?

Yes. You can open multiple MP2 Savings Accounts should you desire

10. Are Pag-IBIG MP2 Savings guaranteed?

Yes, your MP2 Savings are government-guaranteed.

11. Where does Pag-IBIG invest my money?

The Fund invests at least 70% of its investible funds in housing finance, as required by our Charter. The Fund also utilizes

its funds for its Short Term Loan (STL) Programs, and also invests in government securities, time deposits and corporate

bonds.

12. Can my MP2 Savings be withdrawn prior to its 5-year maturity?

The MP2 Savings can be withdrawn prior to maturity under any of the following circumstances:

• Total disability or insanity

• Separation from service by reason of health

• Death of the member or of any of his/her immediate family member

• Retirement (except when the MP2 Saver is already a retiree)

• Permanent departure from the country

• Distressed member due to unemployment limited to layoff and/or closure of company

• Critical illness of the member or any of his immediate family member, as certified by a licensed physician,

subject to the approval of Pag-IBIG Fund

• Repatriation of an Overseas Filipino Worker (OFW) member from host country

• Other meritorious grounds as may be approved by the Pag-IBIG Fund

13. Am I allowed to pre-terminate and withdraw my MP2 Savings prior to its 5-year maturity?

How much will I receive?

Yes, a member may pre-terminate and withdraw his/her MP2 Savings. A member who opts for compounding of MP2

Dividends and later decides to pre-terminate his/her MP2 Savings for reasons other than the circumstances stated

above, shall only be entitled to 50% of the total dividends earned. A member who opts for annual MP2 Dividend payout

and later pre-terminates his/her MP2 Savings for reasons other than those stated above shall only receive his/her total

savings.

14. How can one enroll in the Pag-IBIG MP2 Savings?

Simply submit your duly accomplished MP2 Savings Application form at your nearest Pag-IBIG Fund Branch, along

with the following:

• Valid Identification Card

• Passbook or ATM Card of your nominated bank account

You may download the MP2 Savings Application form via http://www.pagibigfund.gov.ph/dlforms.aspx

15. How do I pay my Pag-IBIG MP2 Savings?

• Salary deduction, for those employed

• Over-the-Counter, in any Pag-IBIG Fund Branch nearest you

• Accredited collection partners. Visit www.pagibigfund.gov.ph/payments/paymentfacilities.html to know our growing list

of collection partners

16. See sample computation on how your money will grow in MP2 Savings!

MP2 Savings of Php500 per month

0 Comments